Since restrictions have been lifted, the PRB Network Marketing team have been delighted to attend more in-person events with Network Marketing organisations.

Chris Whitley-Jones and Cherylin Brooker recently went to an event for nutritional product company Zinzino where they got to meet distributors and share their tips on how to run their business in the most tax efficient way.

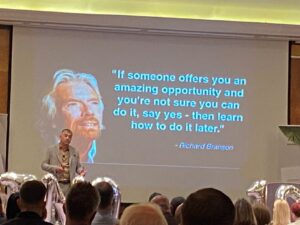

Chris says: “It’s been great to be able to attend in-person events again after having run webinars on Zoom during the Pandemic. Webinars are a great way to get a group of distributors together to share best practice in a time and cost-effective way, but nothing beats seeing people face to face – there’s so much positive energy at these events. I really enjoy speaking on stage and am looking forward to delivering more in-person talks later this year. In our experience, the earlier on in their Network Marketing journey the distributors know about their tax and filing obligations, the less problems there are further down the line.”

Cherylin, who manages the Helpline Service, adds “It’s great to actually meet the people I speak to on the phone. I really enjoy helping people and it’s a rewarding feeling to know that someone is less stressed about their accounts or tax return because of the advice I have given them.”

Frequently asked questions

There are some common topics that come up time and time again when speaking to distributors:

- “What business expenses can I claim for?”

We strongly encourage all Network Marketers to claim for all business expenses they’re entitled to, from business related motor expenses and parking through to household bills if you’re working from home. You can read our full guide on business expenses here.

- “When do I need to register with HMRC?”

You need to register with HMRC as soon as you start trading and complete a self-assessment tax return by the 31st January deadline of the following year. Otherwise, you may face significant fines by HMRC for not registering for self-assessment when you should. You can find out more about this topic here.

- “At what point do I need to complete a tax return?”

Whether or not you need to prepare a self-assessment tax return, depends on how much gross income you received in the last tax year. If you received more than £1,000 of gross income in the last tax year you will need to complete a self-assessment tax return by 31st January of the following year. It’s important to note that gross income is made up of product sales and commission payments. More about this topic can be found here.

Who are the seminars and webinars for?

Chris says: “We tend to find that it’s managers with fairly large teams who approach us in the first instance. They feel that they have a responsibility towards their teams to give them the resources to run their Network Marketing business in the ‘proper’ way, and we can certainly help with this from a best practice and compliance point of view when it comes to their bookkeeping and accounts. The attendees gain knowledge and peace of mind and are being given the tools to run their business in the most tax-efficient way.”

Topics can be tailored to suit the attendees and their current challenges, but the most popular ones are:

- Self-employment

- Bookkeeping

- Year-end accounts

- Self-assessment tax returns

- VAT

- National insurance

If you would like to book Chris for a webinar or an in-person seminar, please do get in touch.